Joe Biden’s administration has taken aim at student loan debt during his first six months in office, canceling more than $ 40 billion in loans and interest for a variety of reasons ranging from fraud on the part of colleges to permanent disabilities for graduates.

Though the administration has not heeded the call of some Democrats to enact a more broad — and much more expensive — cancellation of student debts, Biden has still managed to create relief for many. Read on to find out if these may affect your student loans.

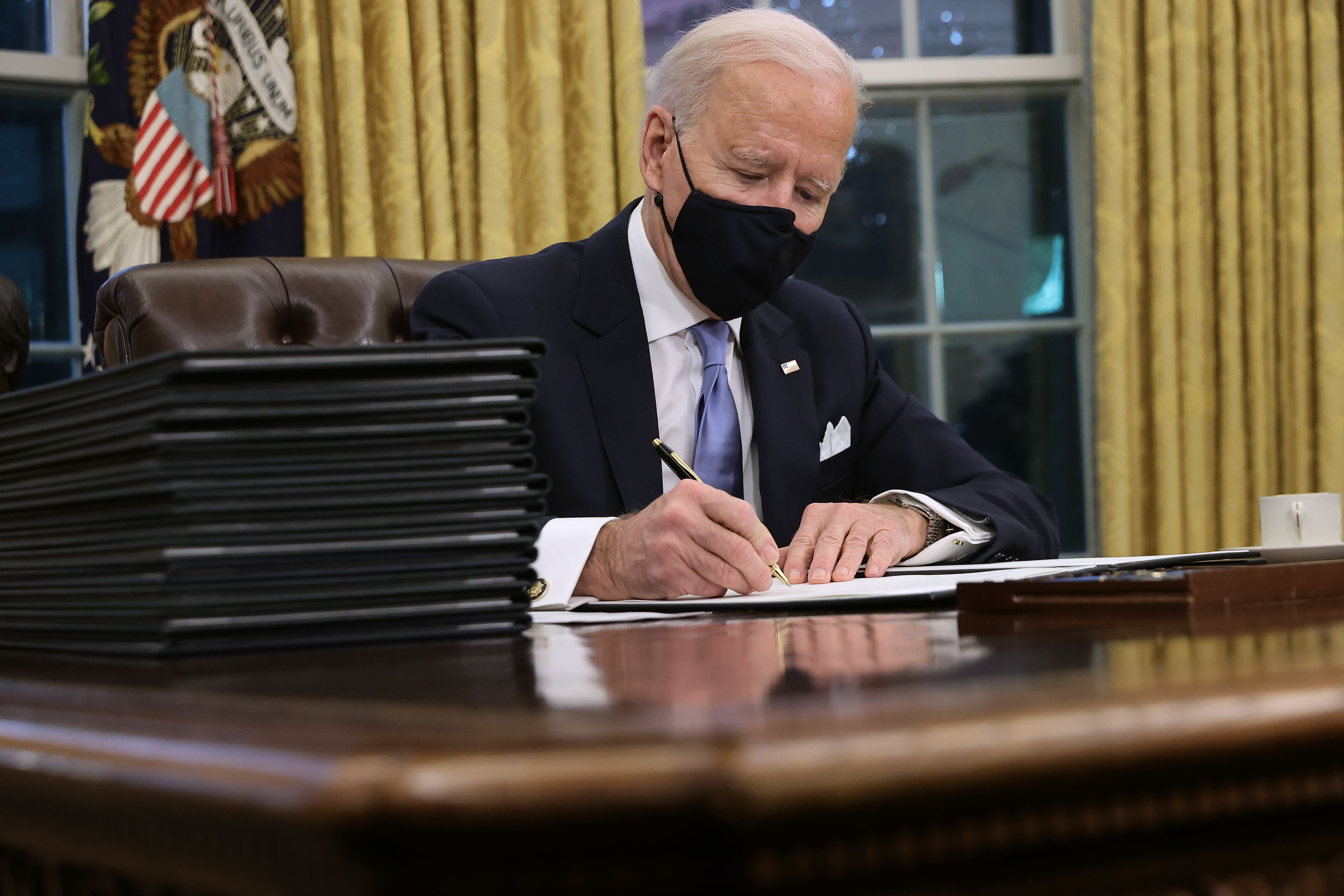

Biden Wipes Out Debt

As Forbes noted, the Biden administration has offered a series of loan cancellations that are targeted to specific situations. That includes $ 1.3 billion for more than 41,000 borrowers with permanent and total disability, another $ 500 million under the borrower defense to student loan repayment rule. Other actions have helped students who were defrauded by for-profit institutions.

Some have called on the Biden administration to enact more sweeping cancellation, including proposal to cancel $ 10,000 in debt for all borrowers, but so far the president has not moved in this direction.

Cuts For All Borrowers

As Forbes noted, the biggest chunk of student loan relief came through the $ 2.2 trillion Cares Act, which included a number of measures to provide relief to pandemic-affected Americans. This includes an extension on relief for student loan payments through the end of September, the report noted.

"That decision alone cancelled $ 40 billion of student loan debt for student loan borrowers," the report noted. "According to the U.S. Department of Education, the temporary student loan forbearance has saved student loan borrowers $ 5 billion per month. By not paying federal student loans and having no new interest accrual on their balance, student loan borrowers effectively got $ 5 billion a month of student loan cancellation."

Loan Interest Forgiveness

As Zack Friedman of Forbes explained, the action to freeze student loan payments is a slightly different form of loan relief. Unlike the other actions that wiped out all debt, this has been more focused on keeping down interest.

"Biden’s decision to extend temporary student loan forbearance — which resulted in $ 5 billion of savings each month — is another form of student loan cancellation," he wrote. "Why? While their student loan balance wasn’t reduced, student loan borrowers saved that money directly and won’t have to repay those savings."

Who Does It Apply To?

For borrowers unsure on whether any of these apply to them, the federal government offers a website that outlines all the different avenues of student loan relief.

In terms of the larger relief, that will likely have to wait. Though reports indicated that Biden was open to the $ 10,000 forgiveness, it was ultimately left out of his first federal budget, CNBC noted. Given his past support for the measure, it could return in the future, but may have to take place before 2022, when Democrats could lose control of the House and Senate in midterm elections.