The International Consortium of Investigative Journalists (ICIJ) began publishing on Sunday the so-called Pandora Papers, a trove of 11.9 million documents exposing financial crimes committed by the global elite.

World-known businessmen, politicians, musicians, models, and athletes have all been exposed in the Pandora Papers, which showed that they hide millions in tax havens.

It comes as no surprise that countries like Switzerland and the Seychelles serve as tax havens, but the Pandora Papers show that one American state is disturbingly accommodating to financial crime: South Dakota.

Read more below.

South Dakota Exposed In Pandora Papers

As The New York Post reported, the Pandora Papers show that around $ 360 billion in customer assets are currently held in various trusts based in the state of South Dakota.

The figure has allegedly more than quadrupled over the past decade, according to the ICJ, which wrote the following.

"The documents provide details about the movement of hundreds of millions of dollars from offshore havens in the Caribbean and Europe into South Dakota, a sparsely populated American state that has become a major destination for foreign money."

South Dakota Laws

Around $ 360 billion is being held in South Dakota trusts because lawmakers have approved legislation "championed by insiders in the trust industry."

According to The Washington Post, which participated in the investigation, South Dakota is now comparable to notorious tax havens around the globe.

"South Dakota now rivals notoriously opaque jurisdictions in Europe and the Caribbean in financial secrecy," the outlet noted.

A few other American states, such as Nevada and Florida, appear to be moving in the same direction, according to the documents.

Human Rights Abuses

Some of the assets sheltered in South Dakota are linked to individuals and organizations that have been accused of human rights abuses.

The documents show that "family members of the former vice president of the Dominican Republic, who once led one of the largest sugar producers in the country, finalized several trusts in South Dakota."

"The trusts held personal wealth and shares of the company, which has stood accused of human rights and labor abuses, including illegally bulldozing houses of impoverished families to expand plantations," per The Washington Post.

Political Implications

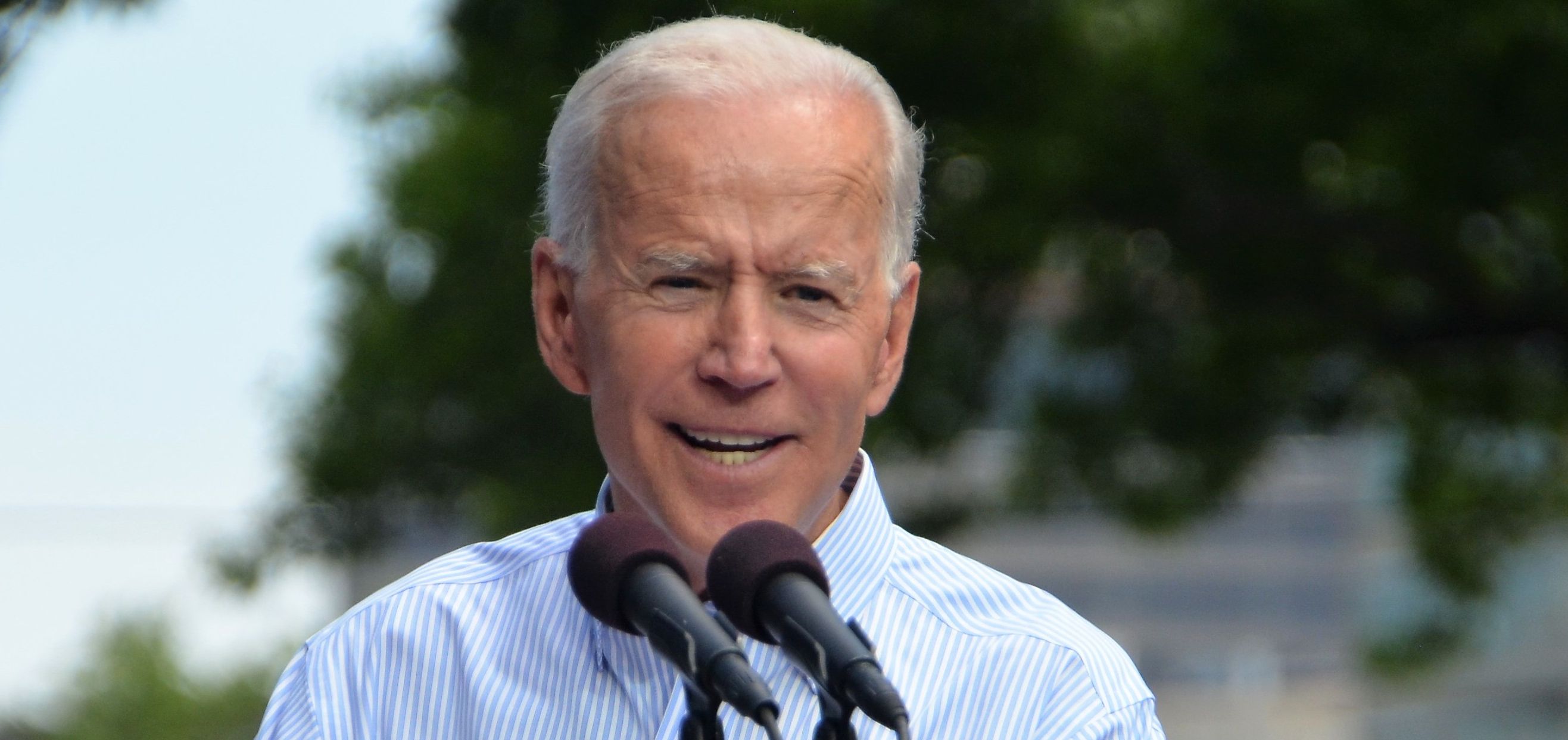

The Pandora Papers show that American states like South Dakota are tax havens, which could be an embarrassment for President Joe Biden, who promised to "bring transparency to the global financial system," according to The Guardian.

ICJ Director Gerard Ryle told the outlet that politicians are the main obstacle to meaningful tax reform.

"When you have world leaders, when you have politicians, when you have public officials, all using the secrecy and all using this world, then I don’t think we’re going to see an end to it," he warned.